Introduction

Investors had a tough time, in the last month. The face of the US stock market, the S&P 500 index slumped over 8%. Almost grazing a correction figure (10%), the S&P 500 live chart keeps investors amidst worries.

After the S&P showed a steady bullish trend, this fall was much unanticipated. Certainly, investors are unnerved. However, there’s hope. Most importantly, remember what Charlie Munger told CNN when commenting on premarket stocks:

“If all you have is one hammer, the whole world looks like a nail.”

S&P 500 investments can take the same turn now. When investors start treating market volatility as a feature and not as a weakness, even a falling market may yield generous results.

In the same vein, I think readers already have a cue of what I’m going to bring up next! Yes, you guessed it right. It’s time to consider investing in S&P 500 ETFs.

More on S&P 500 ETF Funds

Think long-term if your NVIDIA or Salesforce stock isn’t performing as projected in the short term. Above all, you can always invest in S&P 500 ETFs, which is a good way to diversify your investment across the top 500 stocks. If selected stocks don’t perform as expected, others in the index will.

Selecting the Best S&P 500 ETF for 2025

Exchange-traded funds (ETF) easily replicate the S&P market, rightly representing the companies and their respective weights. For people who want to invest in ETFs safely, you can check out Vanguard S&P 500 ETF (NYSEMKT: VOO).

There are other great options. However, Vanguard is one of the most trusted names among investors. The technical analysis also reveals the same.

Firstly, Vanguard S&P 500 ETF offers a very low expense ratio of 0.03% only. Therefore, you pay a charge of $0.03 for every $1000 you invest in the ETF fund.

Initially, it may not seem to be a great cause. But when you invest more, the low expense ratio will matter to you! Throughout FY 2024-25, Vanguard S&P 500 ETF has followed the real S&P 500 chart clinically.

The latest S&P 500 stats say that the original index has a return level of 571.2%. In comparison, Vanguard ETF’s return price percentage is 569.5%.

On that note, here are the top 3 S&P 500 ETFs for March 2025:

| ETF Name | Trading ticket | Projected 5 years returns |

| Vanguard S&P 500 ETF fund | VOO | 17% |

| iShares Core Fund | IVV | 15% |

| SPDR Trust | SPY | 15% |

Pro Tip: You can gain access to any of these RTF funds through a brokerage A/C only. If you haven’t opened one yet, do it now!

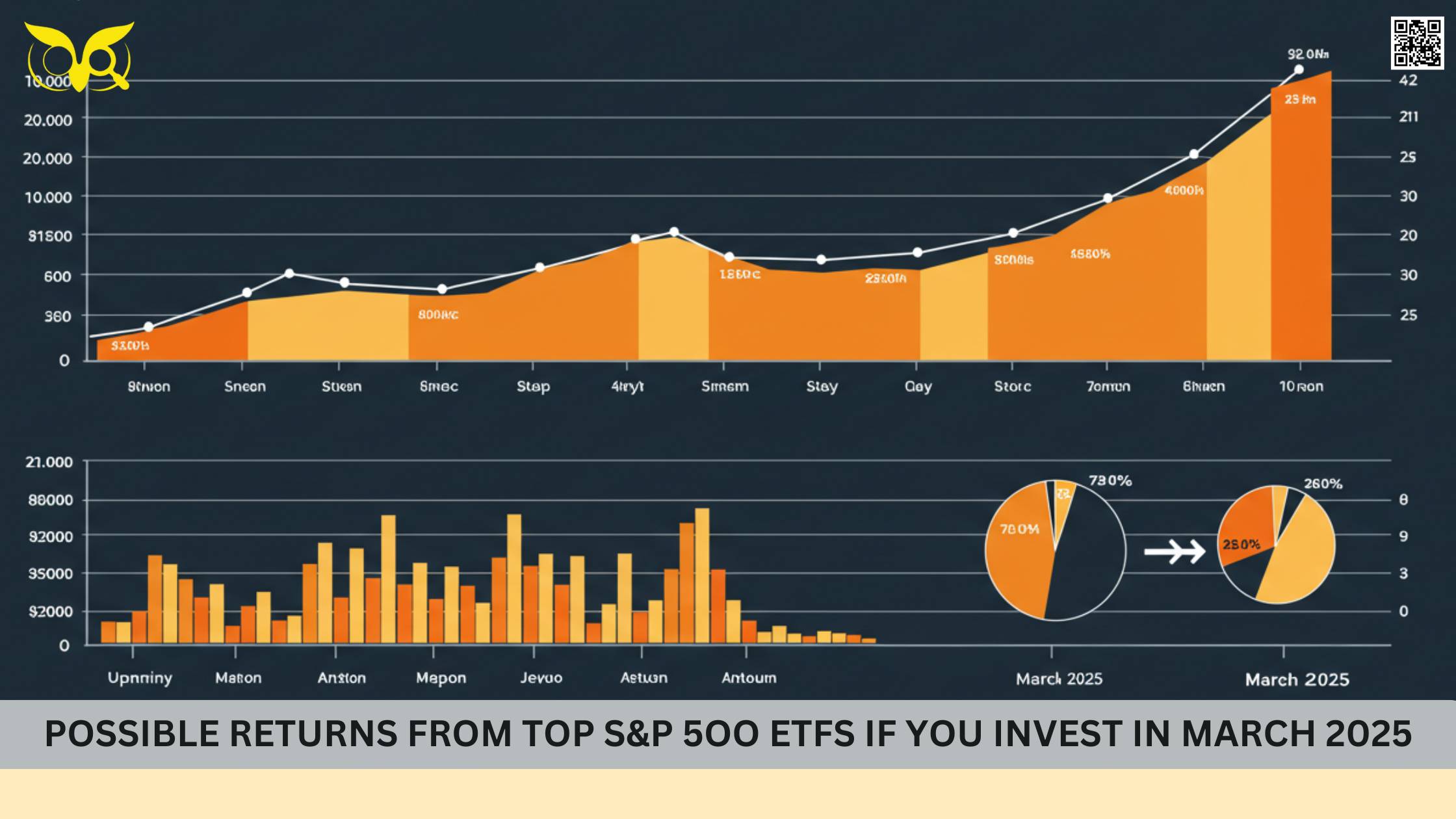

Possible Returns if You Have Just Invested in S&P 500 ETFs

You may use the success rate of individual S&P 500 stocks as a parameter to measure the success of S&P 500 ETFs.

At the same time, you must check the expense ratio and the average market health. In the last 5 years, the average S&P 500 ETF funds returned an average of 108.9%.

Meanwhile, in the current year, the return rate is 11.29% already. It implies that the s&p 500 outlook is quite bullish. Therefore, it is a good time to invest in ETF funds.

Other Factors to Consider While Choosing The Right ETF

You need to focus on 4 prime factors before choosing the best ETF fund in March 2025. The more nuanced these factors, the higher you need to evaluate your choices:

- Expense Ratio

The A/C management fee charged by an ETF fund is its expense ratio. Ideally, ETFs will a lower than 0.05% expense ratio are the best to invest in. However, that is not the only parameter here.

- Trading Costs

There are several brokers in the US offering commission-free ETF investment opportunities to beginners. However, the stock funds of one broker vary from the other.

Luckily, most of the frontline brokerages don’t charge commissions on ETFs. Meanwhile, all of them won’t offer an analysis of the S&P 500 chart today. So, keep that in mind!

- Price

There is a thin difference in the price points at which the S&P 500 ETFs operate. However, it is not a deciding factor. But it affects your returns when you buy a cluster of shares at once.

- Yield and Return Rate

All the S&P 500 ETFs track the same index. However, there are some differences between the price points of the funds. Beginners may think- why do the differences exist at all?

The difference is primarily due to the differential return and yield rate of the funds. These returns can change with time. Meanwhile, you can’t certify that the ETF that offers the highest return in March will do the same in September 2025.

Therefore, we need to look at 5 years return. So, the bottom line is to choose the ETF that has performed well over the last 5 years. The current yield rate might not be magnificent. But it is kiddish to select an ETF based on the latest yield rate (latest 6 months or so) only.

Projecting S&P 500 ETF’s Future Performance

It is next to impossible to track past events to decide the future movement of the S&P 500 index. However, we can use past performances to project possible scenarios from the future. For example, if you want to make basic projections of the future, you need to look at the Black Swan events closely.

These are the major upheavals in the markets that affected the index big time. However, these events are rare. Therefore, we call them black swans.

Firstly, let me recall the September 2001 event. The terrorist attack slumped trade and hit all indices badly. Secondly, the market took a similar hit during the Global Financial Crisis of 2008. The latest was the pandemic in 2019.

The Final Call

Start investing right away. ETFs preserve the best funds. So, there are fewer chances of losing. You can spontaneously invest in any of the 3 ETFs spotted for March 2025.

The best part is that the expense ratios of all these funds are quite low at the minute. You may be tempted into investing in all three ETFs together. However, that’s not necessary. Diversifying your portfolio is a better option.

Source: https://baddiehub.news/